This is an optional tax refund-related loan from MetaBank NA. Charitable donations are tax-deductible for federal income tax purposes.

Penalty For Cashing A Check Twice Legal Action Fees Etc Explained First Quarter Finance

It is not your tax refund.

. In this case the TDS is a dead loss that can neither be recovered or adjusted in ITR. In this case Mr C must check the Form 16 given by both the organisations. Because ActBlue forwards contributions to the candidate cause or committee to whom you choose to.

LODGE 2022 TAX RETURN TODAY AND GET CASH IN 1 HOUR 10 YEARS OF EXPERIENCE Get 1 Hour Tax Refund Our staff at Tax refund on spot are qualified accountants and are experienced in handling all tax matters. ActBlue cannot be responsible for your treatment of these donations on your tax returns. Since provisional taxpayers earn money from other sources they have to complete an IRP6 return AND make manual payments to SARS.

It is not your tax refund. To check on the status of a refund from current year tax overpayment due to reduction of current year assessed values you can contact the Tax Collection Division between 900 am. Her tax liability before any credits would be 271.

Passport when you go into the branch to cash a check as a non-customer. It takes about three weeks for taxpayers that e-filed and chose to get the refund direct deposited whereas it can take more than six weeks for taxpayers. Every bank requires that you have two forms of government-issued ID ie drivers license and US.

Regular taxpayers make their tax contributions to SARS monthly via PAYE deducted off their paycheck automatically and submit one tax return every year for the end of February to describe their affairs - an ITR12. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Monday through Friday excluding holidays at 916874-6622.

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. And rebates and get you the maximum tax refund MytaxMyGov TaxEtax 2022 Australia. To lessen the financial burden of people impacted by the coronavirus the Employees Provident Fund Organisation last year allowed EPF members to make a second non-refundable advance from their EPF accounts to cover financial emergencies caused by the coronavirus according to the labour ministryEarlier only a one-time advance was available for.

If Organisation 1 has also included the joining bonus in Form 16 then Mr C will not be able to obtain a refund of the TDS from the income tax department. Need to cancel your Spirit Airlines flight. In total she would be able to receive a tax refund of 7097.

We break down everything you need to know when it comes to Spirit Airlines cancellation policy. All refund requests are subject to the availability of the contribution funds. They even have a free tax refund calculator available that allows you to know the amount of money that you will be getting back in your tax refund.

Loans are offered in amounts of 250 500 750 1250 or 3500. Loans are offered in amounts of 250 500 750 1250 or 3500. Their online filing services have the ability to import your W2 information into your tax return so you can avoid worrying about your forms being delivered via snail mail.

This is the highest tax refund among these scenarios. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

24 Hours FastQuickSame Day Tax RefundReturn. For additional information please refer to our Supplemental Addenda web page. She would be able to receive a 1071 American opportunity credit 800 refundable and 271 nonrefundable a 3000 refundable child tax credit and a 3297 EIC.

Those who file taxes electronically and receives their refund direct deposited to their bank accounts get it twice as faster as someone who mailed in the return and chose to get a refund check. This is an optional tax refund-related loan from MetaBank NA.

Tax Refunds These Are The Reasons For Delays Marca

How Roth Ira Contributions Are Taxed H R Block

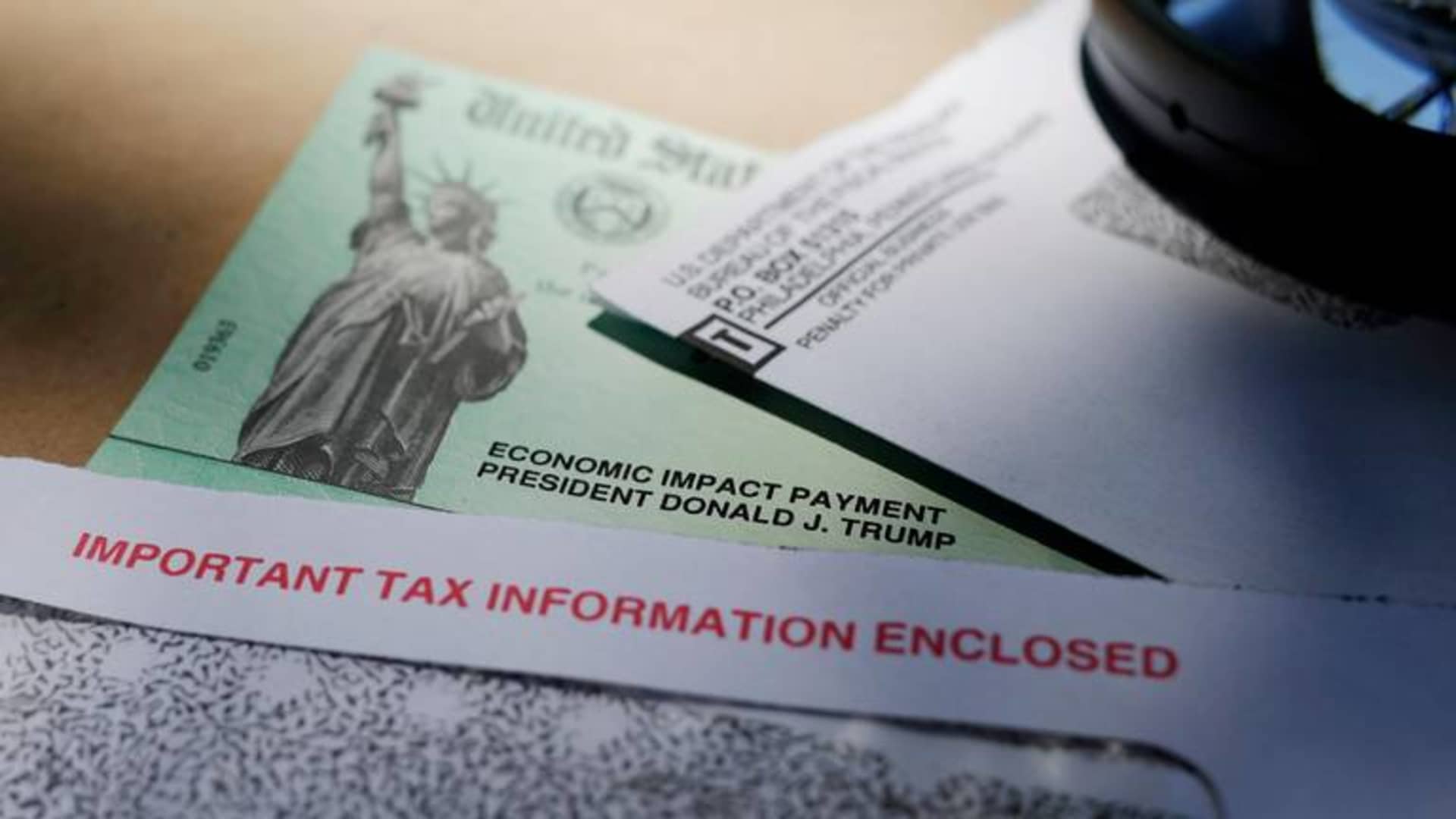

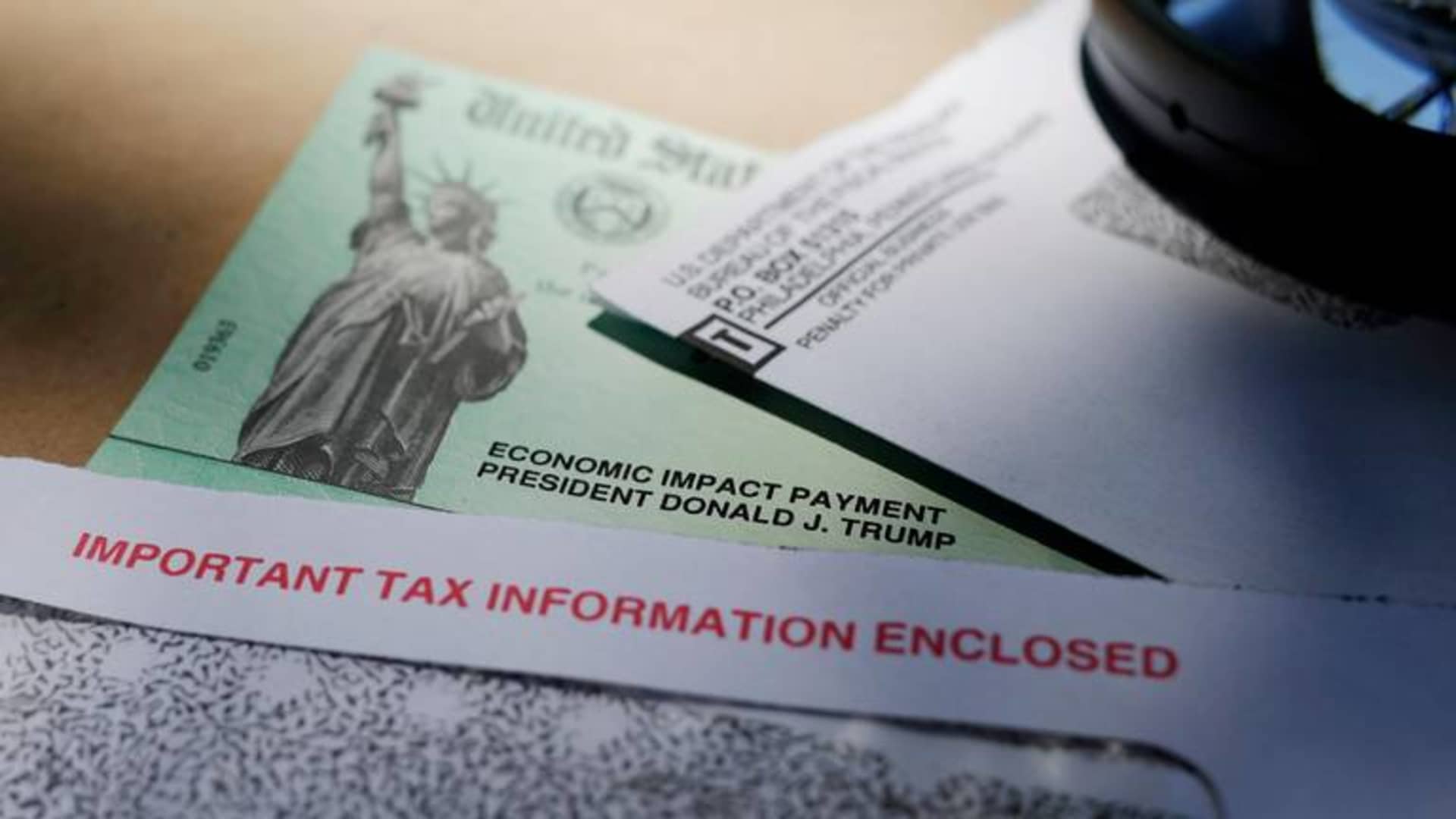

Stimulus Check Scams Here Are Red Flags To Watch For

Turbotax H R Block Users Report Issues Getting Third Stimulus Check

The Irs Just Paid Out 2 8 Million Surprise Tax Refunds Are You Getting One

7 Surprising Things Covered By Homeowners Insurance Homeowners Insurance Best Homeowners Insurance Homeowner

Why The Bonus Tax Rate Is Bad News For Your Tax Refund Gobankingrates

As Indiana Considers Second Tax Refund Some Wonder Where S The First Inside Indiana Business

Income Tax Deductions Fy 2019 2020 Tax Deductions List Income Tax Business Tax Deductions

Tax Refunds These Are The Reasons For Delays Marca

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds

Irs Expands Employer Tax Credits For Paid Covid 19 Vaccination Leave Husch Blackwell

It S Tax Season Will My Alimony Be Tax Deductible In 2021

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

Tax Refund Delays Where Is Your Money And How To Track It Warady Davis Llp

Paystubs With Phone Verification Payroll Template Statement Template Word Template

What If I Told You That By Investing In Your Own Business You Could Turn That Taxrefu Rodan And Fields Business Rodan And Fields Rodan And Fields Consultant